Rick Heitzmann's Futurist Perspectives on Businesses Powered by Computer Vision

/LDV Capital invests in people building businesses powered by visual technologies. We thrive on collaborating with deep tech teams leveraging computer vision, machine learning, and artificial intelligence to analyze visual data. We are the only venture capital firm with this thesis.

At our 7th annual LDV Vision Summit, we had the pleasure to host a fireside chat between Rick Heitzmann, Founder & Partner at FirstMark Capital, and Evan Nisselson, LDV Capital’s Founder and General Partner. They discussed early-stage investing, megatrends, proactive healthcare, actionable data, and the future of AI-powered decision-making.

Rick Heitzmann is a founder and partner of FirstMark. Rick has led investments in market leaders in commerce (StubHub, acquired by eBay), gaming (Riot Games, acquired by Tencent), data services (First Advantage, NASDAQ: FADV; acquired by First American), advertising technology (Tapad, acquired by Telenor), media (Pinterest, NYSE: PINS), sports (DraftKings, NASDAQ: DKNG) and more.

In 2020, Rick appeared on the Forbes’ Midas List as one of the world’s top venture capitalists. He has also received similar distinctions from CB Insights and the New York Times. He serves on the Board of Directors of the New York Venture Capital Association.

Rick holds a B.S. from Georgetown University and an M.B.A. from Harvard Business School.

The following is the shortened text version of the interview.

Evan: Rick, we're honored to have you here, thank you for making time! Let's kick it off with a couple of sentences from you about your investment focus and stages.

Rick: Thanks for having me, Evan.

You’ve been organizing the LDV Vision Summit for seven years now, congrats!

This whole sector has evolved so much.

It's amazing that you started with a somewhat contrarian futurist perspective on computer vision and everything that's happened since, and our co-investments in Ezra and Synthesia.

Also, things that we've done and we've talked about like Pinterest or Hyperscience all are proving that your thesis is working today.

Rick Heitzmann, Founder & Partner at FirstMark Capital

At FirstMark, we call ourselves the first full-stack, full-service venture firm. We started in 2005, almost 16 years ago. Before that, I was an entrepreneur in the data information services world. We grew that company and took it public and sold it for a billion dollars back when that used to be a lot of money. Then we started FirstMark and we started at the earliest stages. As we've grown over the years, we've added a growth fund. Last year, we added a SPAC.

We can invest in companies as early as the first institutional round in the seed. Sometimes we invest in companies even before they're formed, even before they have bank accounts. We can invest through the public markets and hopefully, as we've learned, as being former entrepreneurs, we want to be true partners in the journey. At times, when I was entrepreneurial, you felt like your board was someone who'd beat you if you didn't hit your numbers, which was hard to understand because you're all sitting around the same table with the same goals, trying to solve the same problems.

You share this vision and this empathy for entrepreneurs and being able to share their journey with them and being a partner. Not only as an investor or a board member, but also we invest in surrounding the company with as much love as possible by being able to provide what we call platform services of talent, media and community, corporate development, and a whole array of services that enable companies to feel more included than they might be as a-couple-of-person-startup.

Evan: It is unique to have the full spectrum, full-stack these days, and you've proven yourself with many great early investments that have gone public. What's the biggest thing you learned when you were an entrepreneur at First Advantage that you leveraged to help entrepreneurs maybe avoid mistakes you've done. Is there a golden nugget that you live by now on the investor side?

Rick: It's learning fast and being able to do a lot of experiments to figure out what's working and not. Then you either decide to keep doing that, do more of that, or stop doing that.

One of my favorite questions to ask in board meetings is, “what have we learned since the last time we were all together?”

It could be that computer vision's hard and we need to add more engineers to get to where we want to be, to hit our goals. Or it could be this is a complex problem that requires a lot more education for our customers, so the sales cycle might be longer. Then it enables you to break down and compartmentalize parts of the problem and then take learnings and say, “oh, that's interesting. Therefore, how do we think about our sales cycle? How do we think about how we resource sales? How do we think about our projections for the year? Or are we being too aggressive or not aggressive enough, given what we learned in the last period?”

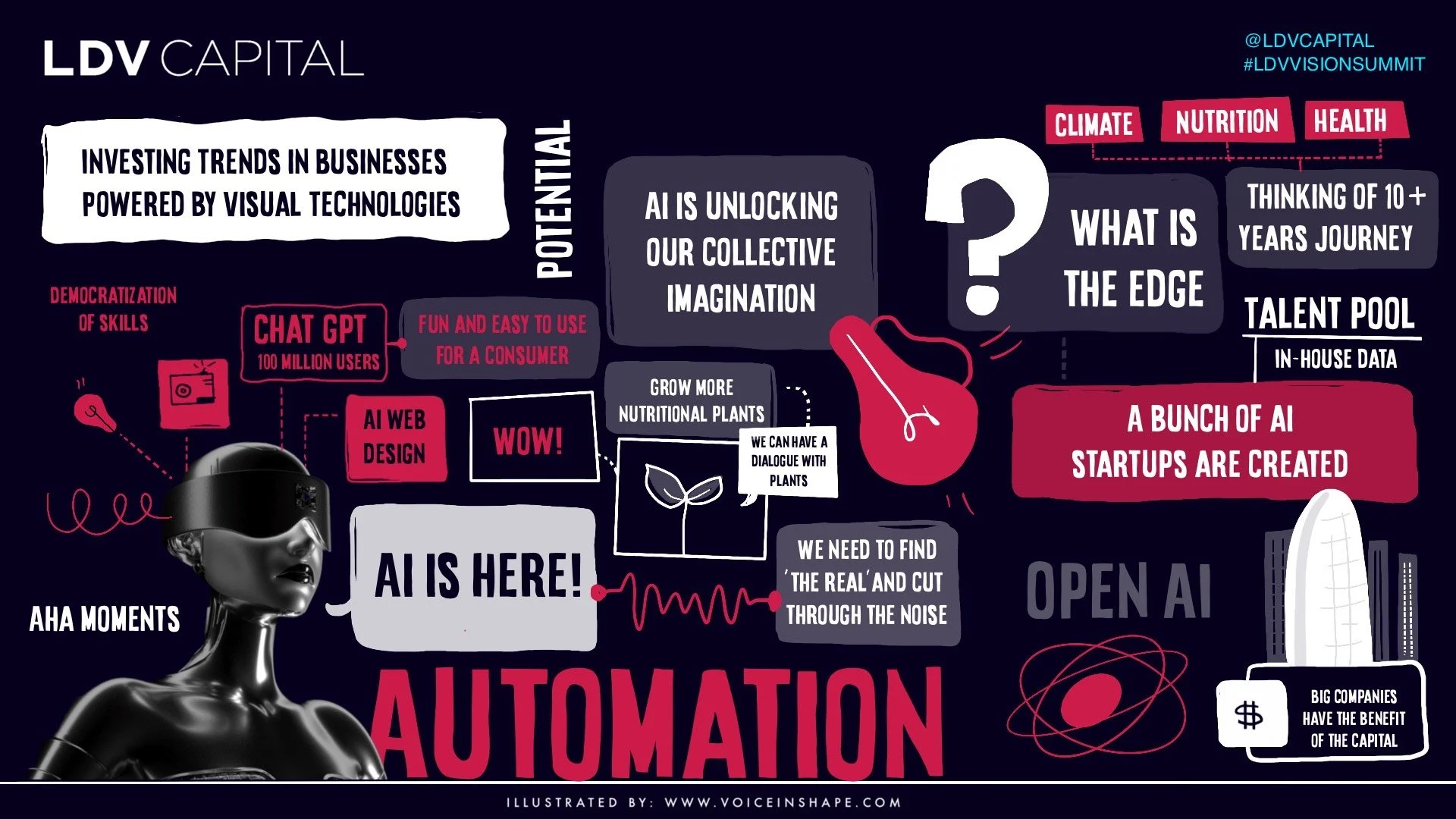

©Voice in Shape

Evan: One of the most important things is to focus your attention in the right place, especially in the early days. I'm reading between the lines because as the company learns and evolves at every stage, there are different focuses. That's one of the hardest things when you're in the weeds as a founder, that the board and/or conciliar can help along the way without getting in the way.

Rick: Exactly. One of the things that we've used at a lot of our companies is the “tomorrow board”. People in and around startups tend to have a lot of energy, imagination, and creativity, and they say, “well, what happens if we do this? What happens if we do that?” Your job as a board member is to help people focus on inputting the resources against the most important goals. Therefore you don't want to be the naysayer and the pessimist who says “no, no, no”. Instead of saying “no”, we say “oh, we'll do that tomorrow. We'll do that. Let's put that on a board. We can't today, we're doing this, but we'd love to do that. That's a fantastic idea! Let's do that tomorrow”. They say “oh, that's great. I'm glad you liked my idea. I'll put that on the tomorrow board. Now we can go back to what we're doing today.”

Evan: You had to raise capital during the nuclear winter after September 11th. Some might say we're in a similar variation of that now, but it's different. How do you see the difference between that period and this period during the pandemic?

Rick: I would probably say that’s one of the closest times we've seen is that last period of March 2020. I would also say right around Lehman and Bear Stearns falling apart in '08, but nothing was this bad. Back when I was a kid, we walked to school uphill both ways, but even in 2000 and in 2001, post-September 11th through about 18 months after people thought technology was dead, the internet was dead, NASDAQ was down 40%. Most of the companies that had gone public in the prior two years had gone bankrupt. A lot of it ceased to exist. That was a lot of going to meetings with firms that didn't have capital but had to be there. They were looking at someone to yell at. It was pretty bad. It wound up taking me 87 meetings to raise $16 million, which helped get me on a path to profitability.

I would say in a different, interesting way we saw some of that fear. We saw people hiding out in March and April of last year. Then, as the market's rebounded, it's almost become the opposite, the pendulum has shifted from fear to greed and people are looking at a zero interest rate environment where they're looking for more projects to take on. We're seeing that in terms of sectors. You're seeing that in terms of all kinds of alternative assets blowing up. It's gone from maybe a C minus or D plus type environment 10 months ago to probably an A or A-plus environment for fundraising today.

Evan: I would agree. We all go through cycles. The question is: when does it go up and when does it go down? We're not sure what's going to impact that, but it will happen. I always remind entrepreneurs that.

You've got a bunch of companies that leverage visual tech from Pinterest, Envision, Optimus Ride, Hyperscience, Ezra, and more. Let’s talk about your investment in Pinterest. They were founded in 2009 and you invested soon after that. Tell us the story of how you met them. How did you decide to invest at such an early stage in such a new opportunity?

Rick: You always wonder what happens to business plan contests and what comes out of those. I met them in 2009, right around the formation. They were two folks that were at the NYU Business Plan Contest. Ben Silbermann's at the time girlfriend's brother, who he knew, unfortunately, now his brother-in-law, was a teacher's assistant for Scott Galloway before anyone knew who Scott Galloway was. He convinced them that even though Ben and Paul or the other co-founder were not NYU students, they should be able to participate in the NYU Business Plan Contest.

They participated there and they had the idea that in a world where there are tons of products and ideas you need a way to capture and curate them. “How are those ideas and opportunities curated by your friends and other experts? In an increasingly visual, increasingly digital world, how do you curate all those things that you want?” We said, “okay”. The iPhone was four or five months old.

Evan: Rick, what did they have?

Rick: They had nothing. The idea was that you're going to have your iPhone, the foreign factor is going to be quite small. People are not going to want texts, they're going to want pictures, and you're going to have to curate those pictures. Then I said, “well, show it to me”. He's like, “well, you didn't give me the money. I don't have anything”. I said, “well, that's interesting, but it's hard. How did you guys do at NYU?” They said, “well, actually we don't go to NYU. I just knew a professor who was involved and so we don't have anything”.

Ben, who had worked at Google and had done a bunch of stuff, was not an engineer. Paul had been a healthcare VC. They didn't have a product, they didn't have the ability to build a product. I said, “awesome, I'm investing”. We did that. It was early on, it was a seed opportunity.

They wanted people to create some bookmark lists or something to say “I like this product and I want to keep it”. They also had a product called Tote at the time. People were ripping out ideas out of catalogs or magazines and saying, “oh, I like this haircut. I like this recipe. I like this sweater. I'm going to rip that out of a magazine and put it in my backpack or my purse. Then save that for later or show that to a friend who might like it.” They wanted to do this in a digital world.

So they said “Hey, we can put this bookmark in the corner of your browser. This way you could clip and save those things. You can share them with people you think might be interested and you can curate your lists. If you think you're a great sweater connoisseur or a great chili cook, you could be an expert in that.

They gradually started and they started largely in a way that a lot of people hated at the time – they promoted Pinterest among middle-aged women in the Midwest. A lot of people thought at the time that that was not the right demographic to start with, because those people don't use the internet, and you'll never be able to build virality. They started very small, but they grew every day, day over day for over five years. It was the impact of compounding, where you start with four people, then you go to six, then you go to eight. All of a sudden, you're at a couple of million people and you're on your way. Then, last quarter, they added a hundred million people. It seems to be working.

Evan: It's a great success story. It's always interesting to analyze those early days. Would you say at that stage, probably, the people were the most important? You were investing in the people. You weren't investing in anything else.

Rick: We always believe in the people because the ideas often change. If they're good people that you believe in and that you share at least the initial vision that matters.

We believed that the world was going to be visual and it was going to need to be curated.

These guys had a very clear lens on how that would happen and they'd had success and they got along well together and it all worked. It was an early seed bet that has grown into a large company today, largely using computer vision as they've expanded. Be able to say, how do you shop a style? How do you shop a look? How do you have related pins? An underestimated technology problem. They often don't get enough credit for it, but they have a couple of hundred computer vision technologists.

Evan: Many venture capitalists avoid healthcare or have historically avoided it because of the bureaucracy, the FDA approvals, and everything else. I disagree with that. There are great opportunities. It sounds like, from your history of investments and our co-investments in Ezra, you're bullish, you're optimistic and you're interested in investing in healthcare. Is that a thesis? Where did that originate and what are you focusing on?

Rick: We're super bullish on healthcare. Probably four of my last eight investments are in the healthcare sector. We like it because it's a huge market that's changing tremendously. We view people taking more control of their healthcare, both their healthcare budget with higher deductible plans, and then also their knowledge. The ability for people to own their healthcare and own their healthcare decisions is much greater than maybe our parents' generation or our grandparents' generation who had a tremendous amount of powerlessness between the medical industry and themselves. They did what the doctor said and didn't question it. Now, with the advent of the internet, distributed knowledge, very micro-level ability to understand the disease, understand how you're feeling, and then take ownership of your care is incredibly important.

Rick Heitzmann, Founder & Partner at FirstMark Capital

We've invested in Ezra with you, which is looking at full-body scans and the ability to catch cancer early, as well as other diseases and potentially save your life.

We've invested in Rowe health, which is understanding you more and being able to provide a full patient-centered healthcare experience in both the digital and physical world.

We have another thing we're announcing soon in and around that space. Then even on the infrastructure side with things like Klarna, we've seen a lot of opportunities to change the way the healthcare conversation is going. It's going to be incredibly important as we think about caring for folks and the ability to have all your care delivered to you digitally.

Evan: We're very aligned in that, Rick. One of the devil's advocates that a lot of people say to me, and maybe to you as well, is that there’s bureaucracy, the FDA approvals, and too many challenges there. It's not the SaaS platform exponentially growing, there are hurdles. I look at those as opportunities with the right team that can surpass that and has defensibility and differentiation. Yes, it's risky, but the right team can get that opportunity. It excites me more rather than concerns me more. It's a reality. How do you view those people that pushed back?

Rick: I agree with you.

You want to do hard things. If you're doing easy things, there are a lot of people that could do it. You create a lot of value and create important companies when you take on hard challenges and regulatory moats.

If you're dealing in the regulatory environment, you can't be scared. We’ve had companies with speed bumps, like DraftKings and Airbnb, where they've had to maybe go too fast and reel themselves in. As you're able to have a conversation with regulators, and as you're trying to prove and prove that you're doing what's in consumers' best interest and empowering people, you think that they're going to hopefully get on the same side. As we think about whether it be democratizing your electronic medical record, whether it be democratizing your ability to gain access to physicians or pharmaceuticals, which might've been hard historically, or even democratizing the ability to look inside your body to see if you're pre-cancerous, you have fatty liver disease, you have a potential brain tumor, at Ezra, all those things are important. It will be hard for regulators to stand in the way of people taking better care of themselves.

Evan: It's all about proactive healthcare. That's been a term that's been talked about for a long time. Why is most healthcare reactive? You go to the doctor, they say ‘late-stage cancer’. There's nothing you can do about it. It's that Holy Grail as Ezra was trying to do. Even my cousin, who is a doctor, said, “well, we've been talking about that forever. It's not going to happen”. I was like, “well, okay. That's one of our challenges as venture capitalists”. Many people will say “no, that's never going to happen”. Somehow you got to choose which person, which opportunity you agree and commit to, and not everything's going to work.

Rick: I agree. With the regulatory environment, sometimes you're right, but you're wrong on timing, which is hard in the startup and venture ecosystem because when you fail, you run out of cash. If you can't continue to hit milestones, you run out of cash. Sometimes it's things like regulators, and sometimes it's things like pandemics, which get in your way of getting from here to there.

The important thing is you're seeing megatrends, whether it's in healthcare or any other sector. We love to have megatrends behind us because they can cure a lot of problems. On the flip side, if you're running in the face of those megatrends, they could knock you down.

If you think about it, this is a time when people are taking more control of themselves. They're taking more control of their learning. They have access to more, better information than ever before, and they're more proactive. You see across the board, even on a generational basis, the younger people understand more about their health, are more proactive in their health, they care more about their health. That's what's going to be important as those folks are willing to spend more of their discretionary dollars, not only their insurance dollars but spend money to take better care of themselves and lead a more full life.

Evan: I agree with you. I'm excited about proactive healthcare. About 30% of our portfolio is healthcare leveraging visual tech from precision bionics to tracking us, the Holy Grail of why is it that our parents and grandparents have security cameras around their house. They don't have health monitor cameras that are managing privacy, of course. This company is called Norbert Health, it does real-time health tracking – vital signs, respiratory, etc. I want them to be able to hear this information before they go to the hospital, not after they're there and the doctor calls me.

Rick: You have Whoop and you have your Apple watch that says ‘here's how you slept last night, here's how you recovered, here's what's going on’. Not that you woke up and you had a heart attack yesterday, here's your cardiovascular health. Here's how you can proactively manage by knowing more.

We just went through a whole cycle of business intelligence, of companies spending trillions of dollars over the last 20 years to know more about where the widget is in your supply chain. Your health is more important. Why wouldn't individuals spend more money knowing more about what's going on inside their bodies?

Rick Heitzmann, Amish Jani and Matt Turck with whom we published an interview in 2019, “Computer vision is an immensely fertile area for entrepreneurs and investors”.

Evan: One of the things that I ponder a lot is that data that you get via your smart devices has historically been interesting, but not actionable. We're getting to a trend towards more actionable data. I don't want to just see it. I know if I don't sleep well. I don't know what this data tells me to do. I'm excited even if just one signal can improve our life.

Rick: I agree. Maybe I'm overextending the analogy, but it's no different than when you looked at AI and business intelligence for companies in the past. “This is what happened to your inventory yesterday” - you need to look at the whole supply chain, demand chain, activity chain. Here's what you need to do to make sure that there's food on the shelves of your grocery store tomorrow, to make sure that you're proactively managing that, and providing artificial intelligence or at least logic to be able to better understand how to make everything work better.

You do need to stand up because you haven't stood up this hour, according to your Apple Watch, or maybe you haven't had your third serving of vegetables, wherever that may be...

Evan: Entrepreneurs always wonder how to get an investor excited. There are thousands and thousands of people that we talk to all the time and likely only invest in less than 1%. For us at LDV, it's probably less than a fraction of a percent because we only do 3-5 new investments a year. We're concentrated. What is your favorite personality trait of an entrepreneur and your least favorite personality trait of an entrepreneur?

Rick: Passion is my favorite, mopiness is my least favorite.

Evan: I ask all of our fireside chat investors this question over the years and ‘mopiness’ is a new one. Tell me what's the most difficult situation you've had as an investor over the years, with an entrepreneur, with a company? What did you learn from it?

Rick: We've changed out some founder CEOs over the years. What we learned is you have to be transparent with people as you go on this mission with them. Being able to say “this is working” or “this isn't working” along the way. “You're not doing the right thing for the company when you do these things, or you need to supplement your skillset by doing these things”. I'm transparent to the point of being aggressive at times, but I don't want to leave anything unsaid, because it's in everybody's best interest.

Evan: I agree with you on being transparent, and direct to a fault.

Rick: If people have a problem, they have advice. You're at least going to be transparent about where you stand.

Evan: What is your biggest mistake as an investor? What did you learn?

Rick: Not seeing the upside.

There's the old saw that you can only lose 100% of your money. There are things that we got overly concerned with corner issues, without realizing if this were to work, this would be huge.

Instead of thinking about what might not have been.

Evan: What do you believe in that seems science fiction today that won't be in 10 to 20 years, that you'd love to invest in?

Rick: There'll be a lot of decisions made for you in 10 or 20 years that now I'm sitting here, we're getting close to lunchtime. I'm thinking about where I am going to get lunch that could be delivered. Do I have to run out and get it quickly? Whatever that is. There'll be something that says, “You're done for 20 minutes. Here are your favorite things. You should get Mexican via DoorDash, and that should be delivered to you. That'll all be processed. It'll serve up, Rick, you haven't had Mexican in a while. Do you want a chicken burrito? Do you want to deliver it on DoorDash? It could be here by 12:15, so you could watch the next session of the conference”. Boom, it’s here. The decision of this visioning process will be much easier.

Evan: I'm one of those guys that wear certain types of clothes that I like for years and years and years. I imagine the e-commerce system of the future knows that I bought that particular piece of clothing 10 years ago and they know that it's going to go out of skew and not be made anymore. I want an email from them to say, “there are three left. Do you want them?” I'll buy them all because I hate when I go and they're no longer available. It should be smart and help us make decisions.

Rick: It could be anything. If someone's scheduled a board meeting in San Francisco, I know you like to take the 7 am flight out. I know you like to fly on United Airlines. Do you also want an Uber? I know where you stayed last time. Do you also want to stay at the same hotel? I know your preferences. I know you like a black T-shirt. Here's how all those things should be able to work together and proactively served up, which is computer to computer knowledge.

Evan: It's fascinating because a lot of people think that's privacy and they're worried about that. I'm the opposite, I want that. I don't want to think about those little things that are so consistent that I have more brain cycles to focus on other things.

Rick: It will free people up and whether that's freeing folks up to make better investment decisions or read a great book, you'll take the cognitive load of smaller decisions off your plate.

Evan: What's the most important advice to early-stage entrepreneurs in building their business?

Rick: Hire the best people. Whether or not you think you have a role for somebody, I've always said ‘go find the five best people you've ever worked with and call them’.

Evan: Rick, this has been fantastic. Thank you very much for joining us. It is so great to have you. We look forward to more co-investments and learning from you every day.

Rick: Thank you, Evan. I appreciate it.

You might also be interested in a fireside chat with Hayley Barna, Partner at First Round Capital about Hayley’s experience as an entrepreneur – she co-founded Birchbox, a company known as an indisputable OG of the beauty subscription box phenomenon, and her insights on trends and investment opportunities in visual technologies.